In our fourteen years of marriage we have never stuck to a budget. Reason? We weren’t convinced we had the money to budget. We needed the cash to pay the bills (electric, house, gas….you get it). And, I can hear you thinking…but that’s WHY you need a BUDGET. This post has a sponsored link to relevant and applicable business resources that you may find helpful.

Right?

While I agree we need a budget, that still doesn’t solve the “low cash flow” situation we are continually in – which is why my husband wants me to continue using a credit card vs.cash for the things I’m responsible to buy.

Since he’s the head of the home I need to respect his wishes.

Work and Home

I work from home as a blogger (freelancing, basically) and at times over the years have done childcare in my home and sold things on Ebay and at a local flea market. Before moving a couple years ago we lived near a stadium and sold parking at our house for extra money, too. My husband works overtime when he can and in the past has even worked two jobs. So there were a lot of separate streams of revenue, but with the right internet tax tools, it wasn’t anything we couldn’t handle.

Though I didn’t plan to in the beginning, I have been homeschooling our boys since our oldest was in first grade. He’s in seventh now. So, I can’t just go out and get a job. I’ve always worked from home or in our homeschool “coop” settings since having children.

Even when we were first married with both my husband and I working and no kids…we still did not make a lot of money and things were tight then.

Even with our Bachelor’s Degrees we have never had jobs that brought us a lot of money over the long haul. Incidentally, he and I both have a hindsight perspective on the “value” of college degrees that don’t amount to much after graduation. Just ask us sometime.

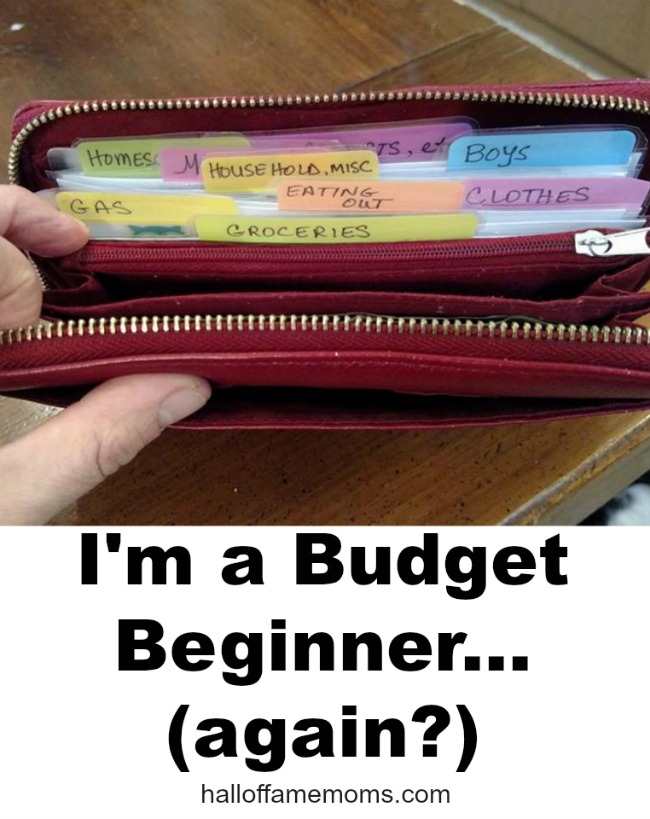

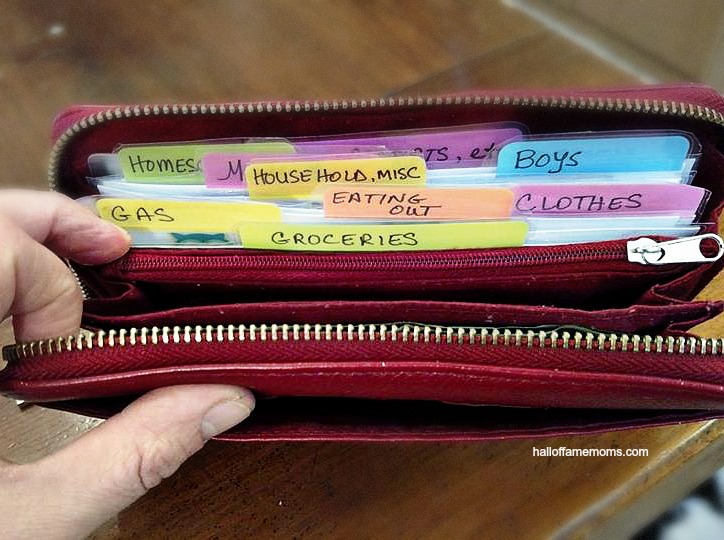

At any rate, I am the one in the family that does about 99% of the purchases related to what our family needs and uses so I am determined to budget (in whatever sense that word will come to mean in our situation) AS IF I am using cash.

Living Frugal

A few weeks ago I began a series sharing my frugal ways. Every Friday I do a Frugal Friday video on Youtube. Frugal living has been part of my lifestyle for years and now I just need to buckle down and work at sticking to a budget.

This Friday I plan to tell you about my grocery budget and how that’s going. If you’d like to get a notice when this video comes out you can subscribe to my Youtube channel here.

Is your situation like ours- where you just don’t feel you have the cash to pay all the bills and buy the groceries, too? How’s your budgeting going?

No, it’s not. Don’t tell Dave! 🙂

I do recommend going Dave’s route though. I’m looking in that direction. Joel is really good about keeping our interest very low. He doesn’t even want to pay a late book fee at the library. 🙂

I hear ya!!! Too much month at the end of the cash; I enjoy using the credit card instead of cash. I know I pay interest, but, I feel I can control my spending better using the credit card for all my purchases and at the end of the month, pay the credit card in full when possible. This certainly is NOT the Dave Ramsey way, is it? LOL…LOL